The Power of Compound Interest: Harnessing the Magic of Long-Term Investing

- Kim Dowling

- Jun 26, 2024

- 3 min read

Unveiling the Financial Superpower

Imagine a world where your money could work tirelessly for you, multiplying quietly in the background while you go about your daily life. This financial magic isn't a myth—it's the power of compound interest. In this article, we'll explore how compound interest can turbocharge your wealth over time, highlighting why starting early and staying consistent are the secret ingredients to financial success.

Understanding the Magic of Compound Interest

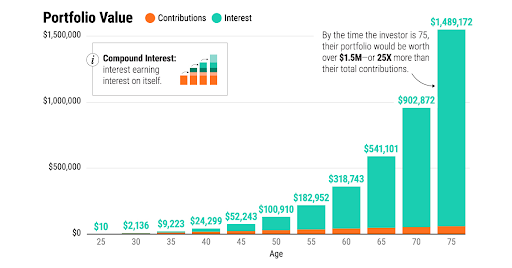

Let's break it down. Compound interest is like planting a seed that grows into a money tree. Here's how it works: when you invest money, you earn not only on your original investment but also on the interest that accumulates over time. Over the years, this interest earns interest of its own, creating a snowball effect that accelerates your wealth.

To illustrate, suppose you invest $1,000 at an annual interest rate of 5%. At the end of the first year, you earn $50 in interest, making your total $1,050. In the second year, you earn 5% on $1,050 instead of just $1,000. This compounds over time, resulting in exponential growth.

The Importance of Starting Early

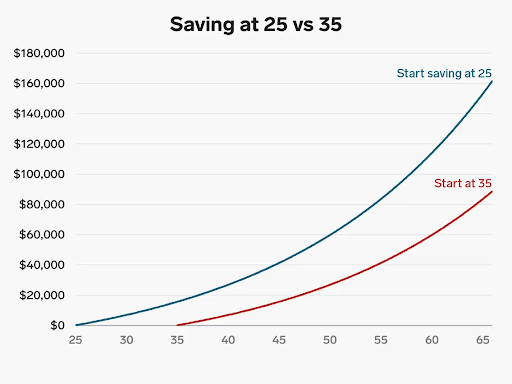

One of the key factors in harnessing compound interest is time. The earlier you start investing, the longer your money has to grow. This is beautifully demonstrated by the concept of "time in the market beats timing the market."

Consider this scenario: two individuals, Alex and Sam, both decide to invest for retirement. Alex starts investing $200 per month at age 25, while Sam waits until age 35 to start investing the same amount. Even though both invest the same total amount, Alex will likely have significantly more wealth at retirement due to the extra years of compounding.

The Impact of Consistency

Consistency is another crucial ingredient. Regular contributions to your investments ensure a steady stream of new funds to compound. Think of it as feeding your money tree—consistently nurturing it over time.

For example, committing to investing a fixed amount every month or year, regardless of market fluctuations, helps smooth out the ups and downs of investing. This disciplined approach keeps the compounding engine running smoothly.

Real-Life Examples: How Compound Interest Works in Practice

Let's put this theory into perspective with some real-life examples. Suppose you start investing $300 per month at age 30 and continue until retirement at age 65, with an average annual return of 7%. By the time you retire, you could accumulate over $500,000. However, if you had started ten years earlier at age 20, you could potentially have over $1 million by age 65—thanks to the power of compounding.

The Role of Investment Vehicles

To leverage compound interest effectively, choosing the right investment vehicles is essential. Options like retirement accounts (e.g., 401(k) or IRA) and diversified mutual funds or exchange-traded funds (ETFs) can provide exposure to a range of assets while benefiting from compounding.

Strategies to Maximize Compound Interest

Besides starting early and staying consistent, there are other strategies to maximize the benefits of compound interest. These include reinvesting dividends, avoiding premature withdrawals, and periodically reassessing your investment strategy to ensure alignment with your financial goals.

Conclusion: The Endless Potential

In conclusion, compound interest is a financial superpower that anyone can tap into, regardless of income level or investment knowledge. The key lies in starting early, remaining consistent, and allowing time to work its magic. By harnessing the power of compound interest, you can pave the way towards financial independence and enjoy the fruits of your patient investing journey.

So, why wait? Start today, and let the magic of compound interest propel you towards a financially abundant future!

Remember, the power is in your hands—invest wisely, invest early, and let compound interest do the heavy lifting. Here's to your prosperous financial journey!

Comments